[ad_1]

Some probably think about it, but free agent star safety Jordan Poyer said it: Professional athletes are thinking about state taxes when thinking about where to play next in free agency.

There’s so much that goes into the free agent process, but the financials of new deals around the league are one of the main factors that entices a player to join a new squad. Of course, state taxes get involved when looking at the grand total on the game-day check.

Poyer has become one of the best safeties in the NFL during his time with the Buffalo Bills after joining them in 2017. He signed a four-year, $13 million deal back then and was given a two-year extension in 2021 worth $19.5 million.

CLICK HERE FOR MORE SPORTS COVERAGE ON FOXNEWS.COM

Jordan Poyer of the Buffalo Bills looks on prior to the game against the Kansas City Chiefs at Arrowhead Stadium on October 16, 2022 in Kansas City, Missouri. (Jason Hanna/Getty Images)

Poyer went on to make first team All-Pro in 2021 and earned a Pro Bowl bid last season.

Speaking on his podcast this week, Poyer discussed where he might go in free agency and said that state taxes are among the boxes to check off.

“I would love to go to a state that doesn’t take half my money,” he said. “It’s crazy to me how taxes work. Some people will say, ‘You’re already making X amount of money.’ Taxes play a big part in all of our lives.”

EX-BILLS PUNTER MATT ARAIZA NOT PLAYING FOOTBALL IN MEXICO DESPITE TEAM’S ANNOUNCEMENT, HOPING FOR NFL RETURN

In New York state, Poyer is in the tax bracket where he makes between $5,000,001 to $25,000,000 annually. So, that means he’s paying $450,500 plus 10.3% of the amount over $5,000,000 at the end of the day in taxes.

Though Poyer is living better than most because of his lucrative contract, those numbers don’t always add up the way people may think after paying his taxes.

Now, if Poyer played in Florida, it’s a different story. Florida doesn’t have state income tax, which is why many athletes are intrigued by joining a team down there.

Jordan Poyer of the Buffalo Bills looks on during the second half against the Tampa Bay Buccaneers at Raymond James Stadium on December 12, 2021 in Tampa, Florida. (Julio Aguilar/Getty Images)

The Miami Dolphins were brought up on the podcast, and Poyer is already friends with their quarterback Tua Tagovailoa despite being rivals in the AFC East with the Bills.

“If it wasn’t Buffalo, it’d be nice to be warm,” Poyer said. “It would be nice to see the sun, maybe, every week or so. Every other week at least.”

Poyer, though, is just excited to see where the free agency process takes him.

BILLS’ JOSH ALLEN ‘STARSTRUCK’ AFTER MEETING TIGER WOODS: ‘NEVER FORGET IT’

“I know how to play this game. I know how to prepare for this game,” he said. “This offseason already has started off great, getting my body right. I feel really good right now.”

“Not really sure what to expect. I do know I’m a ball player, so whatever team does get J-Po, I believe they’re going to be better.”

Other than Florida, Texas, Washington, Tennessee, Alaska, Wyoming, South Dakota, New Hampshire and Nevada have no income taxes.

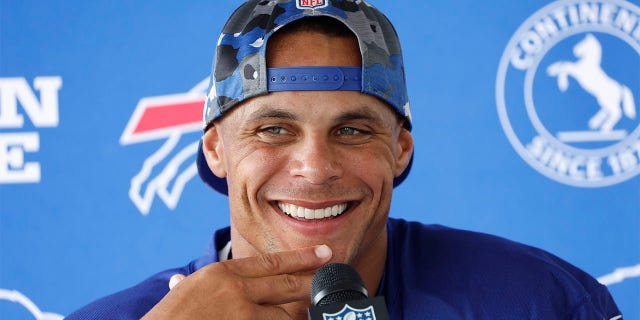

Buffalo Bills safety Jordan Poyer (21) addressed the media following the NFL football team’s training camp in Pittsford, N.Y., Sunday July 24, 2022. (AP Photo/ Jeffrey T. Barnes)

That means, if Poyer isn’t looking for big deductions from Uncle Sam, he can choose the Dolphins, Jacksonville Jaguars, Tampa Bay Buccaneers, Tennessee Titans, Houston Texans, Dallas Cowboys, Seattle Seahawks and the Las Vegas Raiders.

CLICK HERE TO GET THE FOX NEWS APP

The NFL free agency period begins March 15 at 4 p.m. ET.

[ad_2]

Source link