[ad_1]

A 2014 Skift Research report projected that “silent travelers,” namely younger consumers who turned to their mobile devices first to obtain solutions to problems, would upend the travel industry.

To a substantial extent, they did.

Skift argued at the time that silent travelers were using mobile tech to augment and even replace the traditional in-person customer service staff that travel brands historically relied on.

Look no further today than the hotel industry’s emphasis on pushing more customer service features through smartphone apps, the bypassing of front desks at many hotels, and even the proliferation of chatbots, generative AI-powered or not, as accommodations to the rise and maturing of the silent traveler of 2014.

The push to get hotel guests to use smartphone apps and the travel habits of Millennials are having a long-term impact on how properties get developed. Lobbies, fitness centers and even facilities that only employees use were poised to see renovations in large part due to the contactless craze.

And that attachment to mobile devices has only grown stronger, with one survey finding that Millennial travelers would rather lose their luggage on a trip than their mobile phones. A Google study revealed 71 percent of U.S. travelers frequently use their smartphones when traveling. In addition, the same study found 48 percent of U.S. travelers are comfortable researching, planning and booking an entire trip to a new travel destination using only a smartphone.

So with travel brands exponentially increasing their marketing efforts to attract the growing number of mobile-first travelers, is there still such a thing as a silent traveler?

“I think the phenomenon of the silent traveler is still very much in existence, although we don’t really refer to it as such,” said Skift Head of Research Wouter Geerts. “The main thing is that of course this generation that was up and coming in 2014 is now really finding its spending power and has a growing impact on travel bookings.”

Geerts added that “Millennials are, or will soon be, the largest generation in many countries, and the travel industry has been transforming to ensure they can attract this generation. This means a greater focus on online reachability, a different approach to marketing, and greater personalization in return for customer data.”

Here’s a look a further look at how the travel industry adapted to mobile-first travelers and their preferences.

Airlines and Silent Travelers

Skift Research in 2014 cited Delta Air Lines as one company that engaged with the silent traveler. The report mentioned that smartphone- and tablet-equipped customers represented 20 percent of the carrier’s airport check-ins in the two and a half years after it had launched its mobile app.

Big smartphones diminished the popularity of tablets, however.

“It’s a reality of travel, today, that customers are very digitally reliant,” Delta spokesperson Paul Skrbec said in 2014. “They continue to want to be in control of their choices and options in an increasingly mobile way, and the rise to customer adoption has been really, really aggressive.”

Since then, Skift has also covered other airline-related advances benefitting silent — or mobile-first — travelers. Some of these features have stuck, some haven’t.

Google Flights launched a feature in 2016 that informed flyers of when an airfare was likely to expire, risking an airfare hike if the traveler waited too long.

Google took its services a step further in 2018. The tech giant announced that its Google Assistant service would begin sending notifications on mobile phones when it predicts flights would be delayed as well as offer reasons for the disruptions.

Singapore Airlines released a new mobile app the following year that utilized augmented reality, real-time language translation in more than 100 languages and image-based search features. The app features a travel search tool named Capture & Discover that uses image recognition to help users find fare deals and destination.

“In the app environment they [travel companies] can offer travelers increased expediency by knowing their interests and booking patterns in exchange for a competition-free travel planning experience,” Cree Lawson, founder and CEO of location data company Arrivalist, said recently.

Another sign of airlines shift toward mobile-first travelers was Frontier Airlines’ decision in November 2022 to eliminate its call center and to instead provide customers online, mobile and text support via a chatbot available every hour of the day. Travelers wanting to text the carrier can get a link sent to their mobile phones.

“We have found that most customers prefer communicating via digital channels,” Frontier said in a statement explaining its decision, adding the move would help speed up transactions.

Hotels and the Silent Traveler

Skift Research said in 2014 that the silent traveler represented an opportunity for the hospitality industry that hotel executives said they hadn’t seen in decades. Hilton Chief Commercial Officer Chris Silcock acknowledged that companies like his were in a position to reimagine the hospitality experience, combining the physical and the digital.

Indeed, Hilton announced in July 2014 that it planned to enable Hilton HHonors members to select specific rooms via desktop and mobile after making a reservation at several of its hotels, a first for the hospitality industry at scale. Hilton also said by the end of 2015 it intended to allow guests to use their smartphones as room keys at U.S. hotels for four of its brands.

In addition, Hilton said it was testing an app named Fun Finder in 2016 that Skift said was designed to act like a guest’s personal travel guide. The app provided guests with detailed maps, information about on-property events as well as notifies them about offers and hotel figures suited to their specific preferences. Those features weren’t unlike the customized advertisements seen in the 2002 film Minority Report.

Skift Research had argued in 2014 that travel brands need to do more than just react to the changing nature of the mobile connected customer — they need to build a highly personalized experience for each of them. Doing so would help boost bookings amid the projected surge in mobile travel sales.

“Travel brands have grown much better at isolating — if not improving the experience — for the silent traveler by incentivizing ‘in app’ experiences for customers they’ve worked with before,” Lawson said.

Even before Hilton’s moves, Skift covered France-based hotel chain Accor revamping the check-in process to enable guests to check in up to two days before arrival on its mobile app and brands’ mobile sites. Accor said it unveiled those check-in features to adapt to travelers’ growing mobile habits as it had estimated that 47 percent of travel searches occurred via mobile.

Skift found those advances would likely significantly benefit hoteliers as a 2017 study revealed that hotels that incorporate apps into a hotel stay saw higher guest satisfaction. Those hotels were more likely to increase the number of direct bookings if they placed a greater emphasis on improving their apps.

The Ubiquity of the Mobile-First Traveler

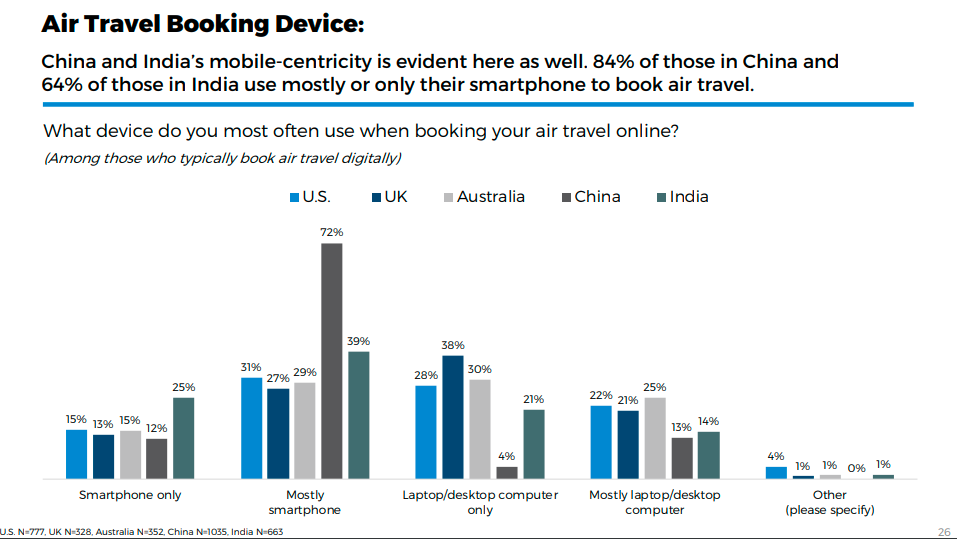

In a 2015 follow-up report on the silent traveler, Skift Research examined mobile behavior throughout the travel industry. Although most travel bookings were still being made using a desktop computer, Skift Research found in a 2019 survey of Millennial and Generation Z travelers that smartphones had come to dominate air travel bookings in China and India.

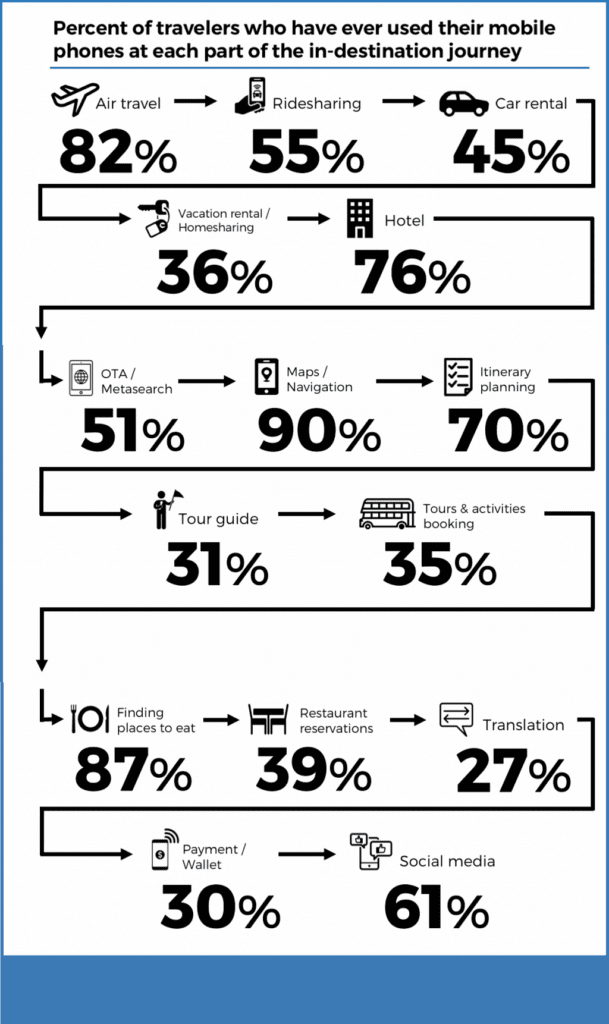

Furthermore, Skift Research also found the previous year that more than half of U.S. travelers used their mobile phones during least eight of 15 possible stages of a trip.

Travel Brands Leveraging Data From Mobile-First Travelers

In January 2023, a Skift article examined how tourism boards were using mobile data to track travelers who stayed with, or visited, friends and relatives, often referred to as VFR, instead of at hotels. Geolocation mobile data enables destinations to track the movement of visitors. Travelers visiting friends and relatives have long been overlooked and difficult to study for destinations they frequently don’t stay at paid accommodation.

However, tourism boards like Explore St. Louis believe they can use mobile data from the visiting friends and relatives segment to turn hosting residents into destination ambassadors and guides.

[ad_2]

Source link