[ad_1]

Skift Take

Traveling to visit a single client could soon be a thing of past, Deloitte’s latest corporate travel study suggests. Instead, businesses see conferences and other live events as a much more productive affair, and will prioritize investing in attending them.

The top reason for international business trips for many U.S. and European companies is related to client acquisition, specifically at conferences and live events.

That’s according to Deloitte’s latest corporate travel study, “Navigating Toward a New Normal,” which found that companies now prefer sending staff away if they have a chance to connect with multiple people.

Companies are calculating the return on investment for a business trip, and “evaluating whether it’s going to just make a sale, if it’s going to keep someone at a company, if it’s going to strengthen their relationship with a client,” said Eileen Crowley, who leads Deloitte’s U.S. Audit & Assurance transportation, hospitality and services practice.

“If you think about these live events, many folks have an opportunity to go to a live event and maybe touch 10 different clients versus traveling to one client site and hitting one chord,” she added.

The new findings back up Deloitte’s earlier Travel Outlook, published in January, which said travel was bouncing back because of “inadequate conferencing software.”

Slower Pace of Recovery

The attendance at live events has jumped from fifth to first as the biggest driver for an increase in travel.

The report, which surveyed 334 U.S. and European travel managers and executives with travel-budget oversight in February, found internal training and team meetings are the most replaceable by technology (44 percent), in comparison to relationship building (11 percent) and client acquisition (7 percent).

“People are willing to go (in person) and companies are supporting it and find value in attending this event, … in bringing people together to make the connections,” Crowley said.

However, although the U.S. and Europe have largely reached pre-pandemic levels of leisure travel for months now, corporate travel is returning at a slower pace, according to the report, which was published on Tuesday.

In fact corporate travel is not projected to reach a full recovery until late 2024 or early 2025, with factors such as traveler safety and the flexibility of virtual conferencing hindering businesses from completely reinvesting in travel.

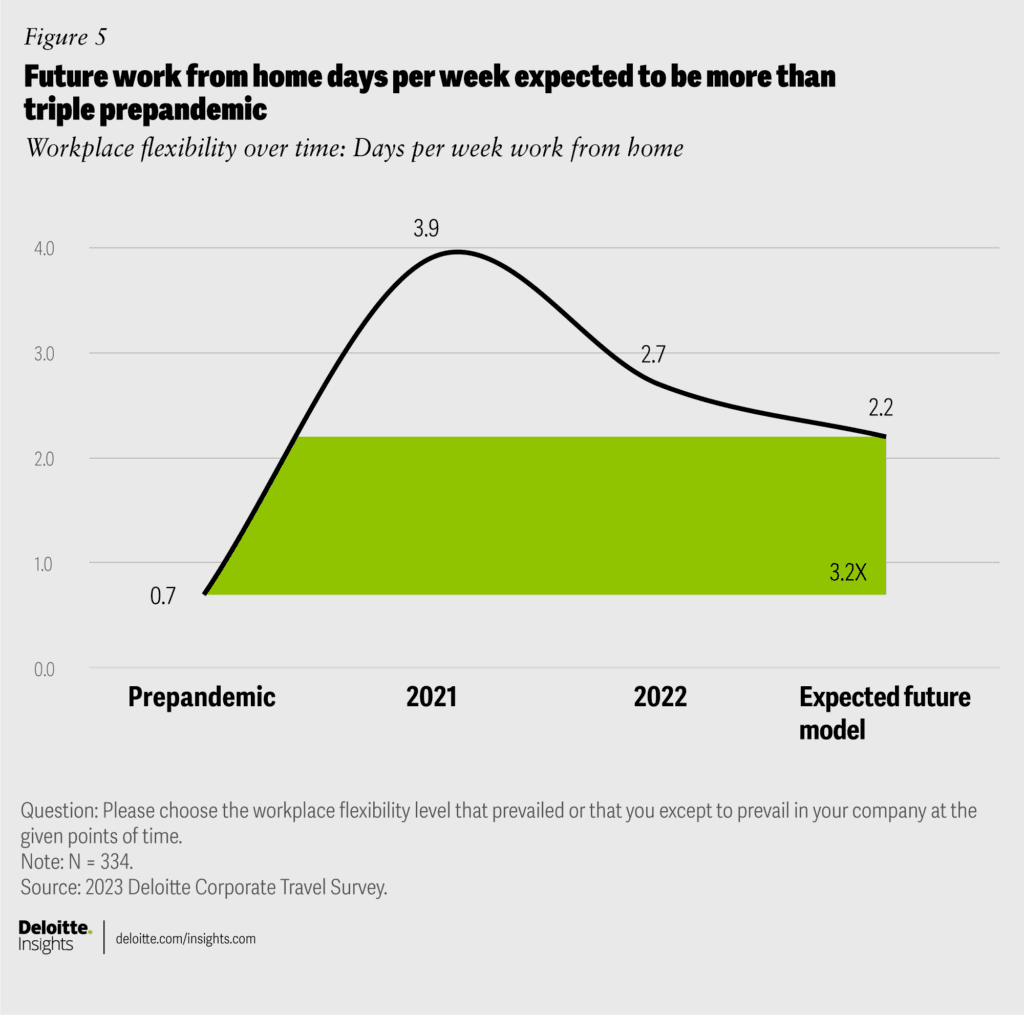

Many businesses are implementing hybrid models, integrating clients into internal events and splitting larger-scale gatherings into virtual venues. That means there’s also fewer trips to offices.

Another factor putting the brakes on corporate travel’s return to 2019 levels is the rising costs of airfares and staying at hotels.

Crowley said that over the past several years, many chief financial officers have become accustomed to saving money by not having to consider travel expenses such as airfare and hotels in their profit-and-loss statements.

“You have to balance the cost when you’re trying to look at what your P&L earnings might be,” she added. “Travel (is a) key to the revenue generation of your business. Companies are evaluating the spend and making sure that they get the best benefit for what they’re spending from a travel perspective.”

[ad_2]

Source link